The British economy may never fully recover from the severe impact of the coronavirus pandemic, a new report by the Tony Blair Institute has warned.

Examining the effects of the lockdown – described as a “Great Pause” in the economy – the organisation claims Covid-19 is likely to cause “permanent damage” with declining tax receipts and surging levels of national debt.

It comes as senior civil servants admitted the economic fallout from a pandemic hitting the UK was never modelled – despite the risk of a virus being one of the country’s most severe threats.

Download the new Independent Premium app

Sharing the full story, not just the headlines

Outlining two major risks to future public finances, the Institute, set up by the former Labour prime minister, also urges government to gradually remove support for the economy, rather than withdrawing measures too quickly that could “exacerbate” long-term damage.

“First, the economy may never fully recover from the pandemic,” the report claims. “If this is the case, tax revenues will be permanently lower than they would have been, and budget deficits structurally larger.”

1/6

Milan, Italy

REUTERS

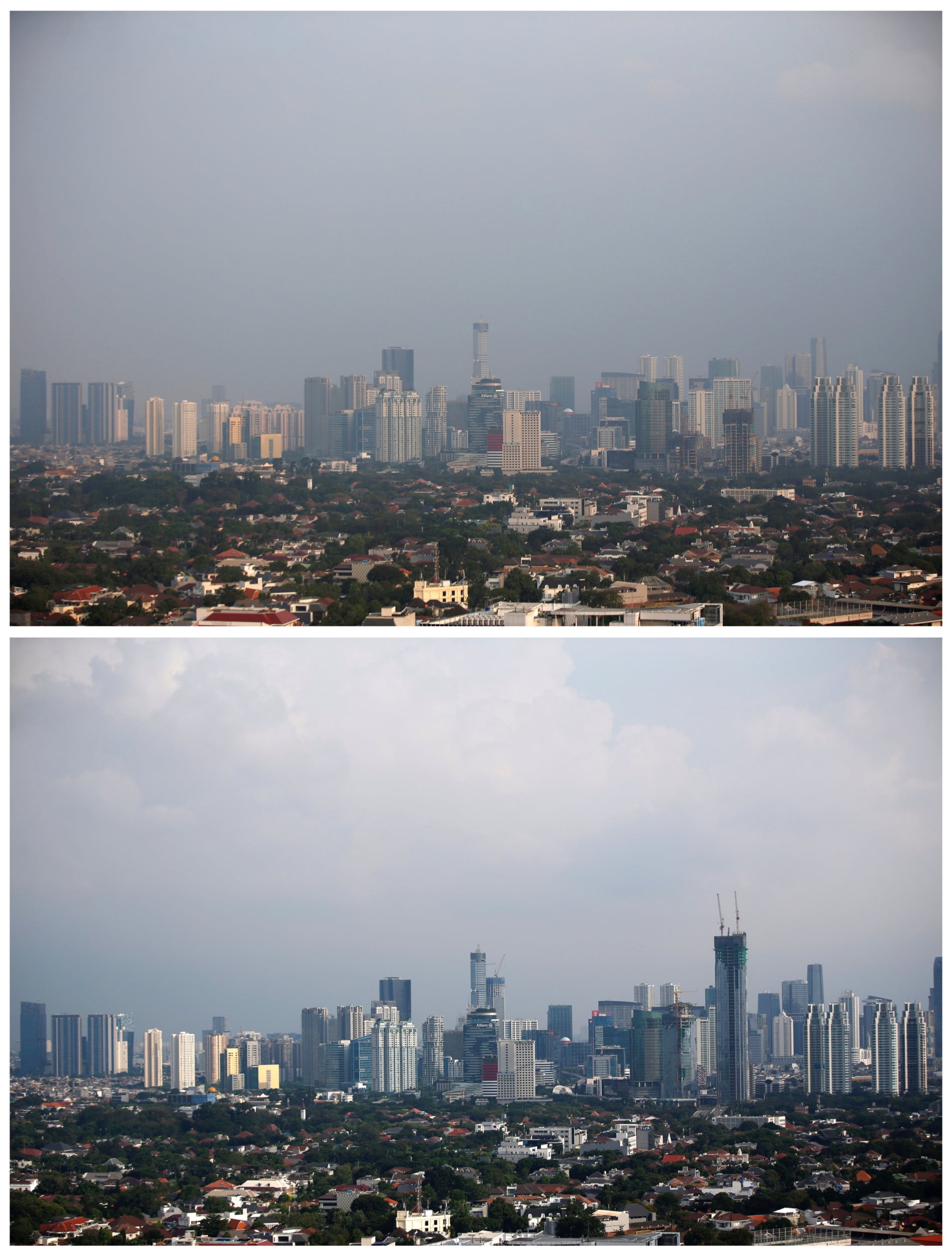

2/6

North Jakarta, Indonesia

REUTERS

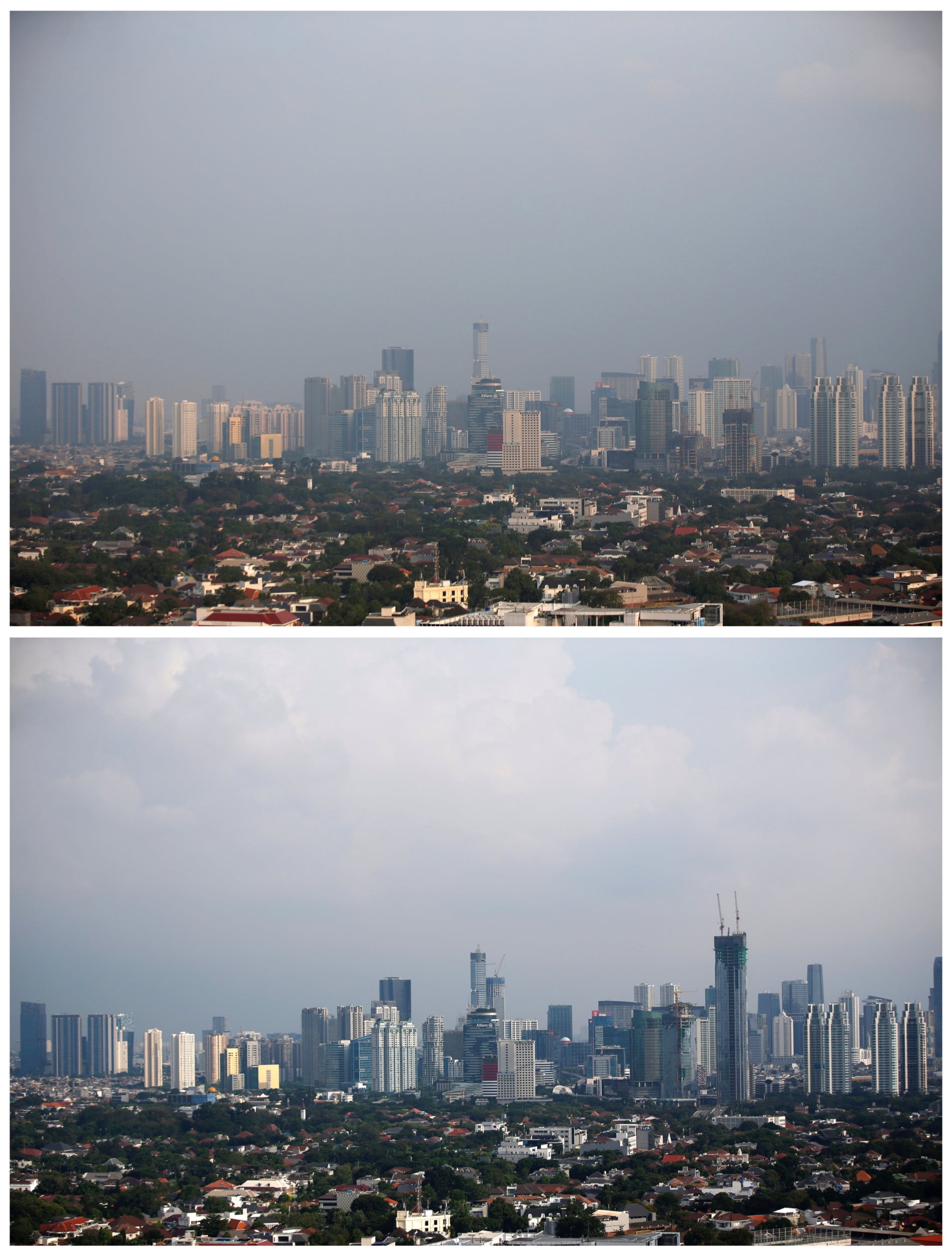

3/6

Jakarta, Indonesia

REUTERS

4/6

Venice, Italy

REUTERS

5/6

New Delhi, India

REUTERS

6/6

Islamabad, Pakistan

REUTERS

1/6

Milan, Italy

REUTERS

2/6

North Jakarta, Indonesia

REUTERS

3/6

Jakarta, Indonesia

REUTERS

4/6

Venice, Italy

REUTERS

5/6

New Delhi, India

REUTERS

6/6

Islamabad, Pakistan

REUTERS

It continues: “Under plausible assumptions of a permanent reduction in economy capacity of between three and seven per cent, without any policy action, debt would start rising again and only stabilise at levels of more than 100 per cent of GDP.

“But here too, at current low interests rates even historically high levels of debt would pose no affordability problem, with debt service costs remaining at record lows.”

However, the report also warns that despite low interest rates, the situation could change radically if interest rates begin to return to historical norms, adding: “If interest rates started to rise from 2025 to reach these levels by 2040, the government’s ceiling on the debt interest to revenue ratio of six per cent would swiftly be breached and debt service costs would be on a path to exceed post-war records substantially.”

The authors pointed out that in the “worst-case scenario”, damage to the economy could see “debt return to levels last seen in the immediate aftermath of the Second World War, by the end of this decade”.

But they said: “Given the historically low interest rates, even such eye-watering debt would be affordable.”

James Browne, the health of work, income and inequality analysis at the Institute, added: “The national debt will rise dramatically during the pandemic. Low interest rates mean that the burden on public finances will be light, however, so we shouldn’t worry about doing whatever it takes now to minimise long-term economic damage.

“But in the longer run it would be a dangerous gamble to assume that interest rates will stay low forever, so the government should make sure debt is falling as a share of national income to ensure fiscal sustainability.”